The property insurance claims process of sending property owners multi-party checks to pay contractors the money they need to perform restoration work regularly involves spending hours upon hours dealing with mortgage companies to get endorsements for each claim check.

On top of that, sometimes when claims are monitored, extra complexity can be added to the payment process (causing even more delays). But, what exactly are monitored claims and what can you expect when working with them as a property owner, contractor, public adjuster, or attorney? Read on for details.

What a Monitored Claim is: Definition

A claim is typically classified as monitored when the total amount is over $40,000 Replacement Cost Value (RCV). However, varying limits may apply as some mortgage companies have higher or lower thresholds based on investor guidelines. Mortgage companies will also consider an insurance claim monitored if the property owner has missed payments or received mortgage relief (like a forbearance or modification) within two years of the date of loss.

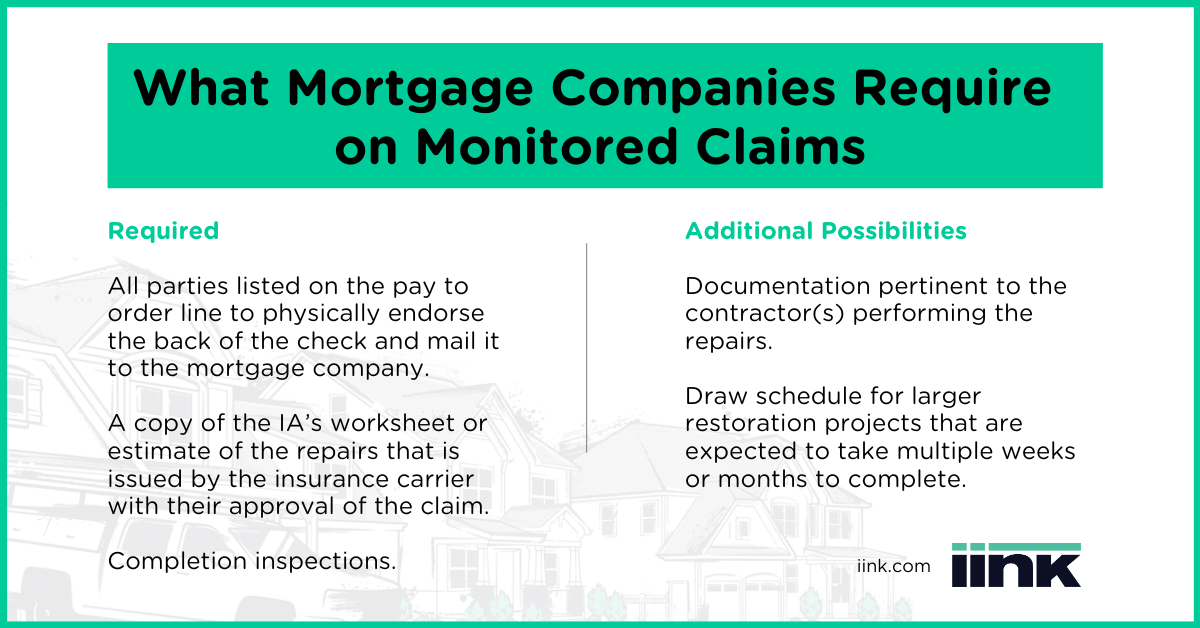

What Mortgage Companies Require on Monitored Claims

When a claim check is deemed monitored, the mortgage company requires all parties listed on the pay to order line to physically endorse the back of the check and mail it to the mortgage company.

The check is deposited into an escrow account in the property owner’s name from which disbursement payments are issued based upon project progress and completion. The initial disbursement payment may only be a portion (25 to 33%) of the initial actual cash value (ACV) insurance check until further build documentation is received.

The mortgage company will also request a copy of the insurance adjuster’s worksheet or estimate of the repairs, that is issued by the insurance carrier with their approval of the claim. If a claim settlement was reached, a copy of the settlement letter or final release should be provided.

Additional documentation pertinent to the contractor(s) performing the repairs may be required including copies of their professional license, certificate of insurance, performance bond, W-9, contractor agreement and waivers of lien. Draw schedules could be requested for larger restoration projects that are expected to take multiple weeks or months to complete.

Completion inspections are also required by the mortgage company to confirm repairs have been met according to the claim documentation. Inspections are scheduled with the mortgage company’s loss draft department and usually assigned to a third-party provider who will perform an on-site inspection.

Once the inspection photos and report are reviewed by the mortgage company, additional funds disbursements are made. The majority of these inspections are scheduled at 50% completion and 95 to 100% for the final.

What this means for property owners: Since the mortgage company will not release additional funds until they review each build inspection report, property owners should try to schedule inspections seven to ten days ahead of work completion to reduce delays on additional draw or final payment while waiting on an inspector. If your contractor doesn’t receive final payment in a timely fashion, a lien could be placed on your property until their invoice is paid in full (potentially, with interest).

What this means for contractors: You’ll want to send the mortgage company your contractor agreement, preferably including a direction of payment and your W-9 so they can add you as a payee to the disbursement checks. However, adding your company as a payee isn’t always guaranteed so you’ll want to get a third-party letter of authorization signed by the insured so you can follow up on the status of the check disbursements.

What this means for public adjusters: Mortgage companies don’t make the payment process for public adjusters any easier as they are often removed as a payee on disbursement checks. Ultimately, the PA’s letter of representation (LOR) and/or contract with the insured for services rendered as part of the claim settlement is their formal record of payment owed.

What this means for attorneys: Same as with PAs, property attorneys are removed from disbursement payments and sometimes utilize their own escrow accounts to remove themselves as a payee before sending the checks to the mortgage company. Property owners inherently want their repairs completed as soon as possible so working out an appropriate percentage split of the mortgage company’s disbursement payments ahead of time will keep the insured happy while paying down the legal bill.

Mortgage Company Monitored Claim Guidelines: A Varied Approach to Managing Claim Checks

Mortgage servicing companies have unique sets of guidelines provided by Government Sponsored Enterprises (GSE’s) such as Frannie Mae, Freddie Mac, and USDA/Farmer Mac for how the process should be handled. So, each mortgage servicing company is required to manage the loss based on the mortgage loan’s investor guidelines. On top of that, a large majority of mortgage companies outsource their loss draft servicing to third-party providers that manage the process for them.

What this means for property owners: Call your mortgage company’s loss draft department to find out what their requirements will be to issue disbursements. When you receive your insurance check, make sure the mortgage company listed as a payee is who you currently make mortgage payments to. If it’s incorrect, the check will have to be reissued by the insurance company after you’ve updated your policy information with your insurance agent.

What this means for ALL restoration professionals: Be understanding but diligent with your customers if you’re relying on them to handle the mortgage process on their own. If you’ve decided to manage the process “in-house” be prepared to track information on a couple hundred mortgage companies so the process can be streamlined on future checks. Don’t forget to have your customer sign a third-party letter of authorization so you can follow up with the mortgage company!

Why a Claim Would Not Be Monitored

Claims with a total RCV of less than $40,000 are generally considered non-monitored as long as the insured has no mortgage delinquencies, modifications or forbearances within two years of the date of loss. Insurance companies may also exclude the mortgage company as a payee on the depreciation check if the job is confirmed complete with a certificate of completion and/or completion photos.

If you’re a property owner who is filing an insurance claim for the first time, you’re likely not sure where to begin. You know that your home is in distress and you want to get back to normal ASAP. Commonly, you’ll soon learn you need to work with your insurance and mortgage companies to get your insurance claim check/homeowners claim checks endorsed and because the process as noted above is not so straightforward on monitored claims or even non-monitored claims, you feel burdened on top of an already damaging situation.

If you’re a contractor, you’re busy running your business and spending time dealing with mortgage companies is not an efficient use of your time. You could end up spending hours on the phone with the mortgage company, driving around to get signatures from multiple parties or having to pay for FedEx tracking labels to get signatures on each check—a process that slows the claims process down even more due to checks sometimes getting lost in the mail and FedEx visits needing to be made.

iink can help move claims along for both property owners and contractors. We do so by managing the process of multiple disbursements for contractors, coordinating property inspections, and moving multiple checks involved on a monitor claim through the iink platform. This time-consuming process entails hours of administrative processing that we take off your plate.